Notes:

1 The nominal yields for 2018, 2019, 2020, 2021 and 2022 are calculated based on the change in the value of one unit for the respective year, according to the methodology of the Financial Supervision Commission (FSC).

2 The investment risk is calculated using the standard deviation of returns as per the FSC methodology.

3 Sharpe Ratio values are disclosed only if the nominal return achieved is higher than the risk-free return for the relevant year. The Sharpe Ratio is calculated according to the FSC methodology.

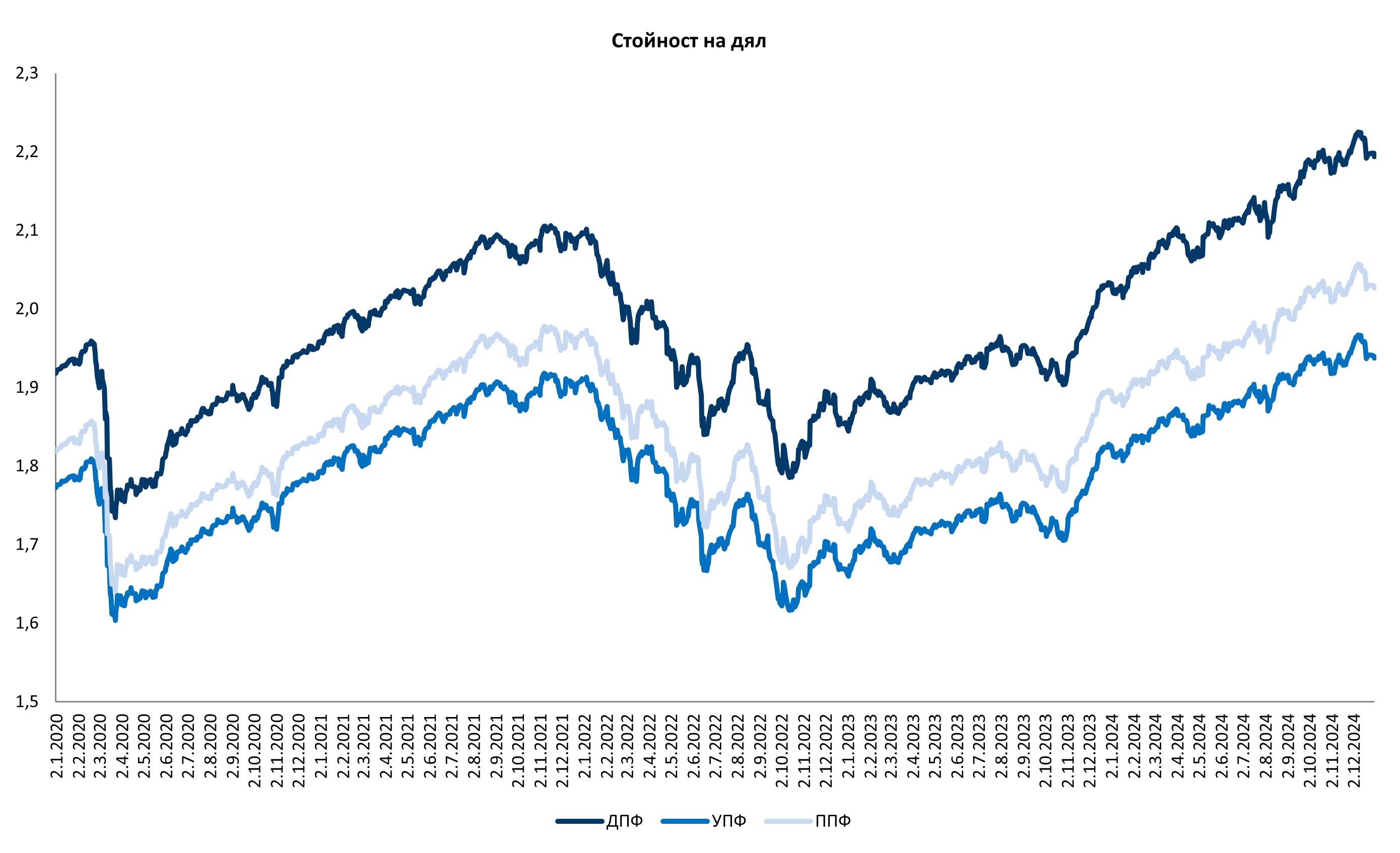

The returns shown are not necessarily linked to future performance. The value of a unit is subject to daily reassessment, and this value may increase but may also decrease. The return on investment of the funds is reflected in the change in the value of a unit and the Company does not guarantee a positive return. For the professional and voluntary pension funds, the company does not guarantee the retention in full of the funds paid into the individual accounts.

4 Returns for 2022 are calculated according to the methodology of the Financial Supervision Commission (FSC).

5 The investment risk is calculated using the standard deviation of returns according to the FSC methodology.

The UBB Life Annuity Fund and the UBB Term Annuity Fund are registered in the Bulstat Register and were approved by the FSC on 12.10.2021 and 05.10.2021 respectively, therefore the information disclosed for them is for 2022 only.

The stated yields are not necessarily related to future performance. The investment return on the funds is reflected in the change in value of the financial instruments held by the funds and the Company does not guarantee the achievement of positive returns.

Changes in the principal investment objectives and restrictions during the period for which results are disclosed can be found in the investment policies of the respective funds.

Return calculation formulae (available in Bulgarian on Bulgarian part of this website)

Explanation of the meaning of return and investment risk indicators used in the disclosure of the investment performance of supplementary pension funds (available in Bulgarian on Bulgarian part of this website)

Explanation of the significance of the performance and investment risk indicators used in the disclosure of the investment performance of superannuation funds (available in Bulgarian on Bulgarian part of this website)

Methodology for calculating the performance and risk indicators for supplementary pension funds (available in Bulgarian on Bulgarian part of this website)

Methodology for the calculation of return and risk indicators for pension funds (available in Bulgarian on Bulgarian part of this website)

Until 01.07.2004 (the date of entry of the value units) the return of the pension funds managed by "Pension Insurance Company UBB" EAD for a one-year period is calculated in accordance with DAON Guideline #3 dated 21.02.2001.

Digital Portal

Digital Portal Offices

Offices 0800 11 464

0800 11 464